Disclosure :: This post is sponsored by E. Francis Financial.

Also, if you need a term life insurance quote, you can receive one here.

A Guide to Getting Financially Organized

Have you ever wanted to get your financial life organized, but weren’t sure exactly where to start? Maybe not positive what documents to hunt down? Or maybe it just seemed too daunting a task without a guide? Well, hopefully this can serve as a general guide to get you started!

In addition to the sense of satisfaction you’ll feel upon completing this manageable endeavor, it’ll really come in handy when it comes to things such as applying for a mortgage, writing a will, meeting with a financial advisor, and more.

As a disclaimer, this is meant to be more foundational than exhaustive. Of course, everyone’s financial life looks vastly different. With that in mind, let’s go!

What to gather

- Tax returns

- Budget

- Cash account statements (checking, savings, CD’s, etc.)

- Workplace retirement plan statements (401k, 403b, 457, SEP IRA, SIMPLE IRA, etc.)

- Personal retirement account statements (traditional IRA, Roth IRA, annuity, etc.)

- Non-retirement investment account statements (taxable brokerage, custodial, 529, etc.)

- Real estate and other property documents (title, deed, etc.)

- Liability statements (mortgage, student loans, car loan, credit card, etc.)

- Insurance documents (life insurance, disability, long-term care, health, etc.)

- Deferred income statements (social security, pension, etc.)

- Legal documents (wills, trusts, etc.)

- Proof of identity and relationships (social security card, passport, marriage certificate, etc.)

- Login information for any online accounts

What to do with them

First, determine how and where you want to store them. There’s no one system that works best for everybody. The goal is to keep them secure and relatively accessible so you can get your hands on them when they’re needed.

Second, identify key information as you sort through all these documents. Most importantly, check that beneficiaries are up to date on all accounts and insurance policies. This is a simple task that can have tremendous implications. Beyond that, ensure that names are spelled correctly and that contact information is accurate.

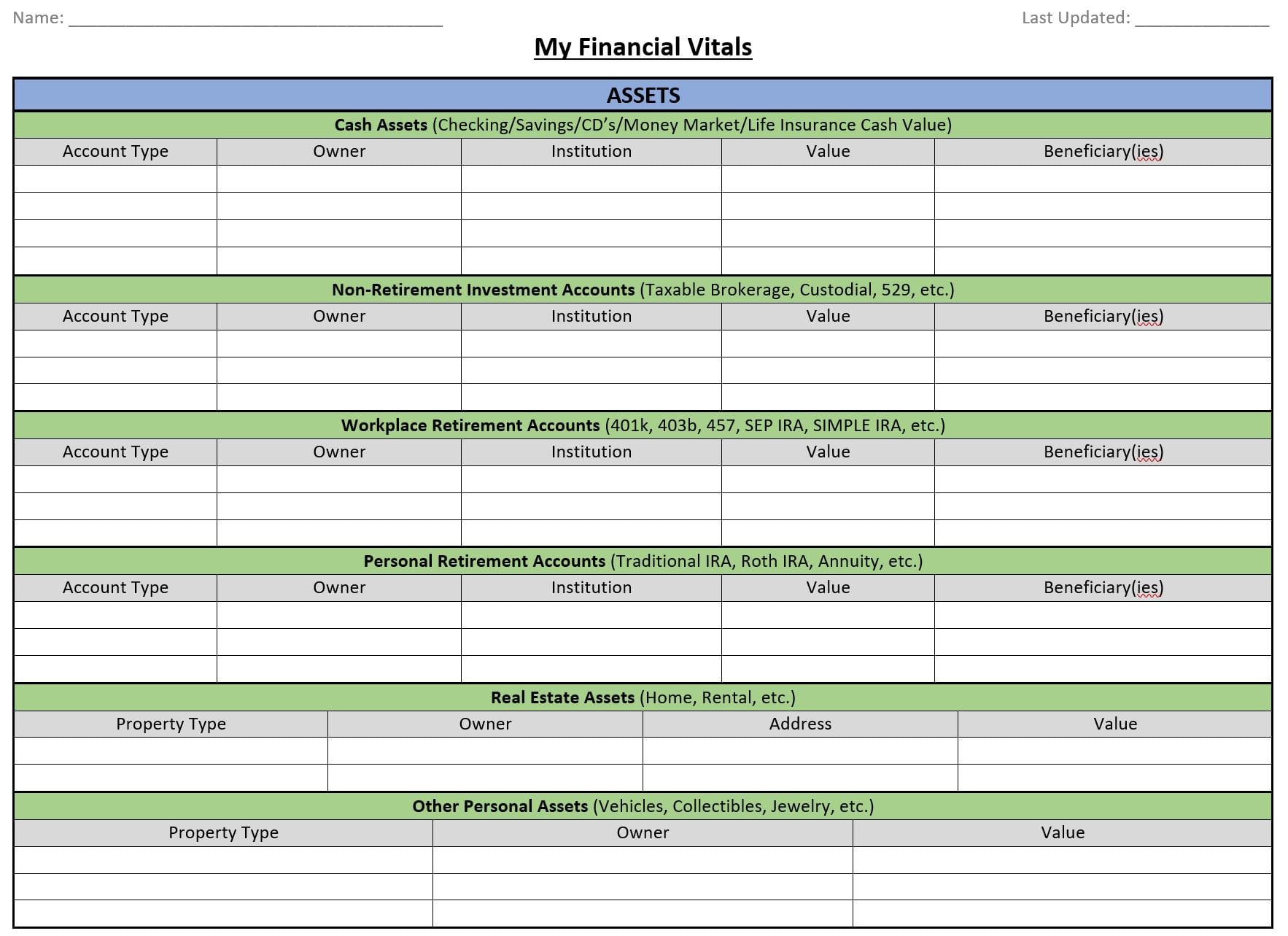

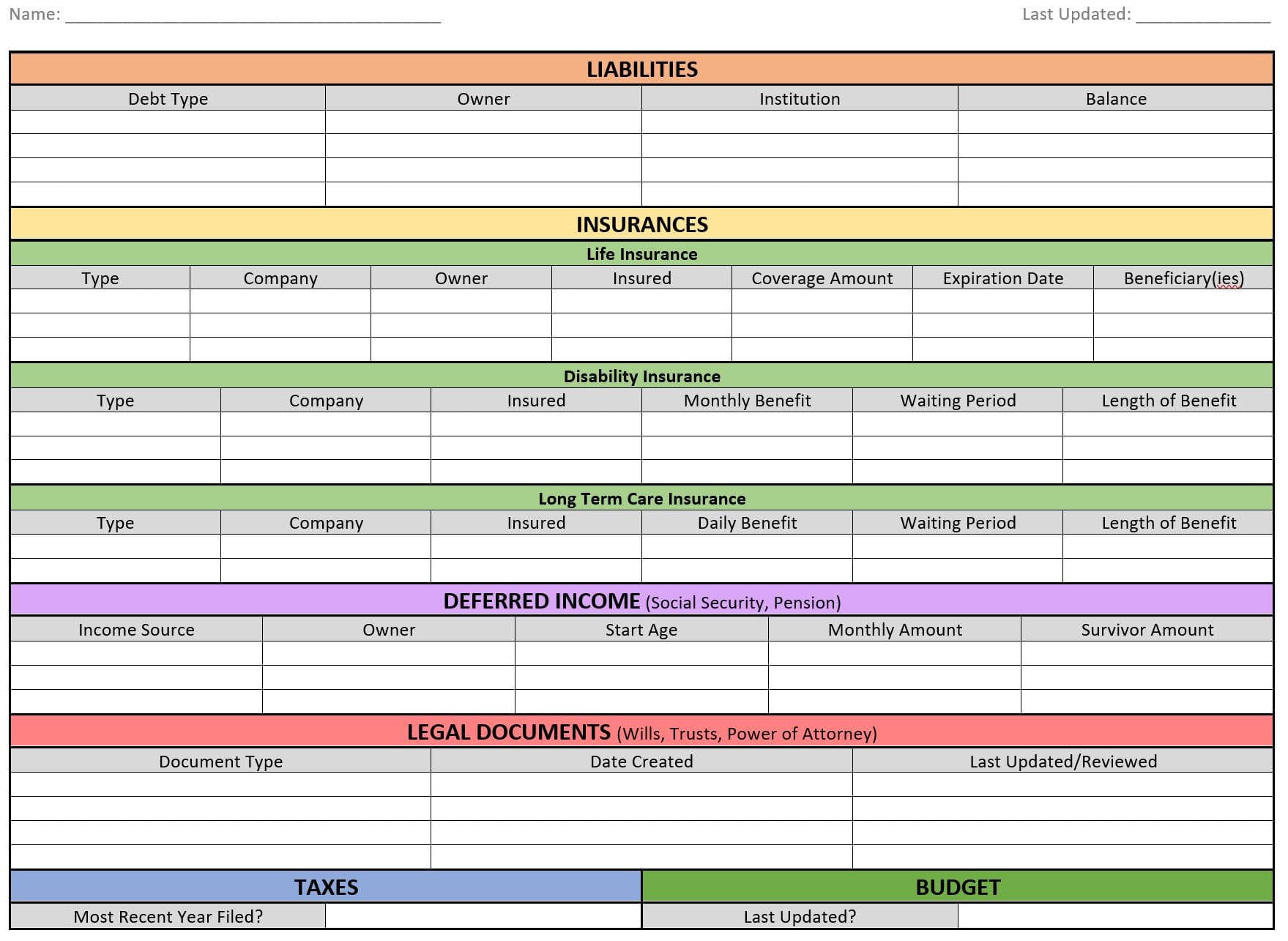

If you want to really maximize the organization, establish a system for compiling the most pertinent financial information in a condensed fashion – something that’s only a page or two and gives a snapshot of the whole picture. Here’s an example:

Imagine being able to assess your household’s financial makeup with a quick look at one spreadsheet or chart. Consider who else should be aware of the same details and even have access to the documents above. Sharing this with heirs or other trusted family members can make matters much more manageable in the event something unexpected occurs.

Imagine being able to assess your household’s financial makeup with a quick look at one spreadsheet or chart. Consider who else should be aware of the same details and even have access to the documents above. Sharing this with heirs or other trusted family members can make matters much more manageable in the event something unexpected occurs.

When to update

The idea here is to reduce stress over time. With that said, reviewing and updating these documents no more than once a year is enough (doing so more than that may have the opposite effect). Consider tackling it along with your taxes.

To be honest, the first time going through this process may come with some speedbumps. But if it’s done thoroughly, the annual updates will be immensely easier. And most importantly, getting organized now frees up time for doing what you truly enjoy down the road.

Learn more about E. Francis Financial ::

Website: www.efrancisfinancial.com

Facebook: www.facebook.com/EFrancisFinancial/

LinkedIn: www.linkedin.com/in/ejurgielewicz/

Twitter: @EFrancisFin

Eddy Jurgielewicz is the founder and president of E. Francis Financial – a financial planning practice focused on helping growing families navigate the path to their own definition of success. Having been a high school teacher for a few years prior, Eddy brings much of the same skill set into his current role as an adviser – serving as an educator first and foremost. In doing so, he helps provide clarity to even the most complex planning, allowing his clients to feel confident along the journey to achieving their unique financial goals.

Eddy Jurgielewicz is the founder and president of E. Francis Financial – a financial planning practice focused on helping growing families navigate the path to their own definition of success. Having been a high school teacher for a few years prior, Eddy brings much of the same skill set into his current role as an adviser – serving as an educator first and foremost. In doing so, he helps provide clarity to even the most complex planning, allowing his clients to feel confident along the journey to achieving their unique financial goals.