Disclosure :: Louisiana Credit Union League sponsored this post.

It’s International Credit Union Day

Today is International Credit Union Day! You might think Credit Unions are just another kind of bank, but you’d be very wrong. Credit Unions are members of our local community, and work very differently than the large banks you might be familiar with. In 2014 alone, Louisiana credit unions provided more than 282,000 consumer loans and over $180 million in business loans.

Learn more by reading the infographic at the bottom and then click on through toASmarterChoice.org to find a Credit Union near you.

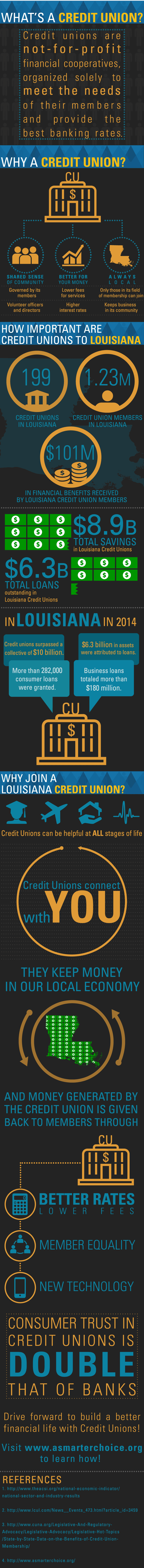

What’s a Credit Union?

Credit unions are not-for-profit financial cooperatives, organized solely to meet the needs of their members and provide the best banking rates.

Why a credit union?

Shared Sense of Community

- Governed by its members

- Volunteer officers and directors

Better For Your Money

- Lower fees for services

- Higher interest rates

Always Local

- Only those within its field of membership can join

- Keeps business in its community

How Important are Credit Unions to Louisiana?

- Number of Louisiana credit unions :: 199

- Number of Louisiana credit union members :: 1.23 million

- Louisiana credit union members received in financial benefits :: $101 million

- Total savings in Louisiana credit unions :: $8.9 billion

- Total loans outstanding in Louisiana credit unions :: $6.3 billion

In Louisiana in 2014…

- Credit unions in Louisiana surpassed a collective $10 billion

- $6.3 billion in assets attributed to loans

- More than 282,000 consumer loans were granted

- Business loans totaling more than $180 million in 2014

Why Join a Louisiana Credit Union?

- Credit Unions Can be Helpful at All Points of Life

- Credit Unions connect with you!

- Keep the money in the local economy

- Money generated by the union is given back to members through better rates and lower fees

- Member Equality

- New Technology

- Consumer Trust in Credit Unions is Double That of Banks!